Award-winning PDF software

Cary North Carolina online IRS 1120S 2025 Form: What You Should Know

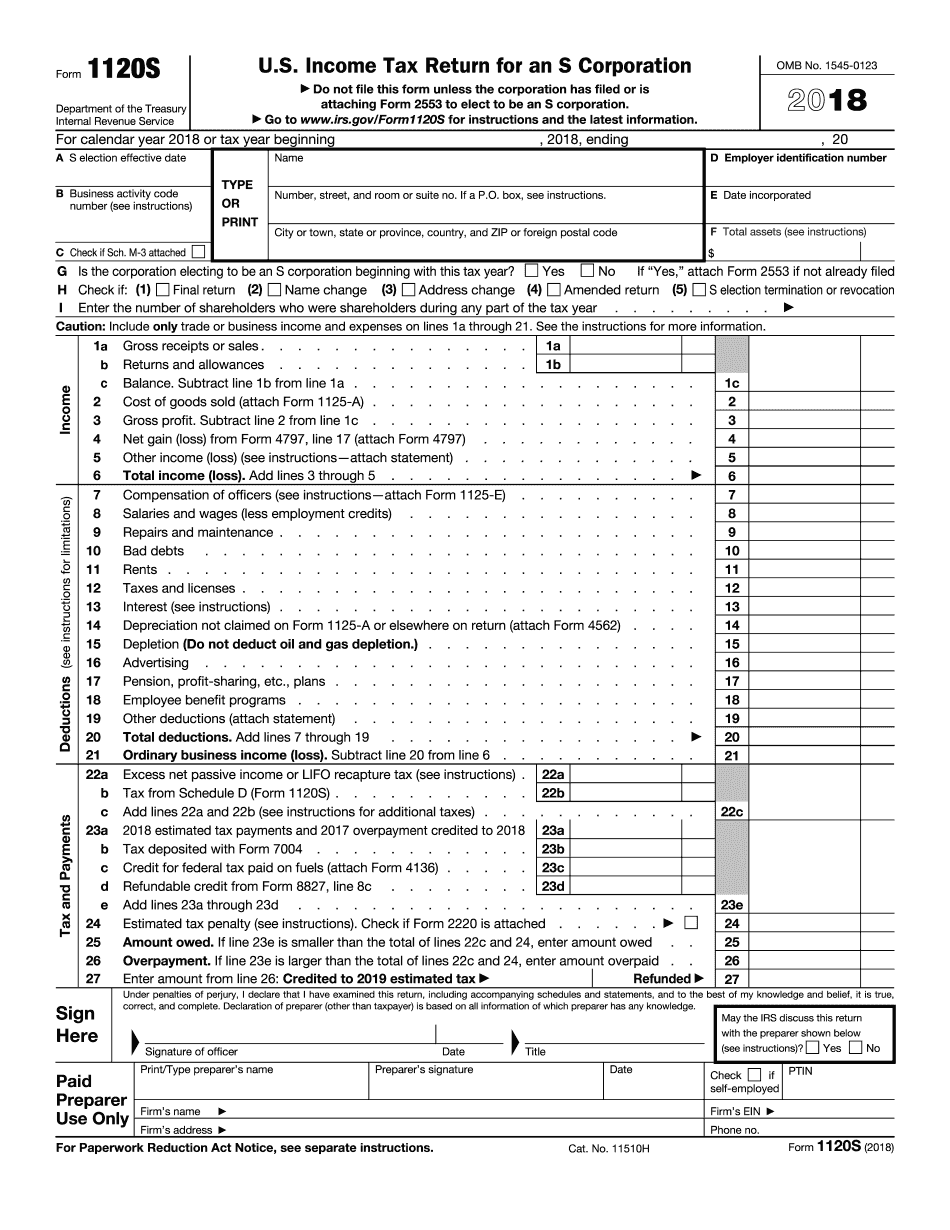

Aug 2, 2025 — Find IRS mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in North Carolina. Form 1120 from North Carolina's Division of Corporations and Federal Tax Exempt Organizations Form 1120 from North Carolina's Division of Companies and Federal Tax Exempt Organizations Form 1120 from North Carolina's Division of Corporations and Federal Tax Exempt Organizations Forms & Instructions | Internal Revenue Service You are required to file federal income tax returns to claim most of these federal tax benefits and exemptions. You may apply for exemptions by taking an examination at a local public revenue office. To make your taxable income as low as possible, your company must file its income tax return on or before the close of the year following the tax year in which it earns the amount of income. This also means that you need to file your return for the taxable year that is 10 or 21 days prior to the tax due date. For more information, see Pub. 1319, Tax on Unearned Income (Individuals, Heads of Household, Business, etc.), available at IRS.gov. Publication 15, Tax on Unearned Income, offers guidance on filing and calculating your tax. A summary of the tax is included in the instructions to IRS Publication 15. For more detailed information about the tax provisions, go to IRS.gov. Federal Tax Information for Small Businesses Small business owners should be aware of a few important federal tax requirements before conducting business in North Carolina. First, North Carolina may not be an ideal location for small business. However, with its low costs, abundant resources, and quality colleges and universities, North Carolina has attracted many local business owners with its attractive tax and regulatory environment. However, federal income taxes are imposed on the owners of any business that conducts taxable activities, such as sales or purchases of commodities or property. Second, small businesses should keep detailed records of their federal taxable income and expenses. They should have an accurate statement on Form 2553, Form 1120-S, or Form 1120-N to report, pay, or obtain benefits from the following programs: Health Coverage: Federal Employees Health Benefit Plan, Federal Employees Group Life Insurance, Supplemental Security Income Program.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Cary North Carolina online IRS 1120S 2025 Form, keep away from glitches and furnish it inside a timely method:

How to complete a Cary North Carolina online IRS 1120S 2025 Form?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Cary North Carolina online IRS 1120S 2025 Form aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Cary North Carolina online IRS 1120S 2025 Form from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.