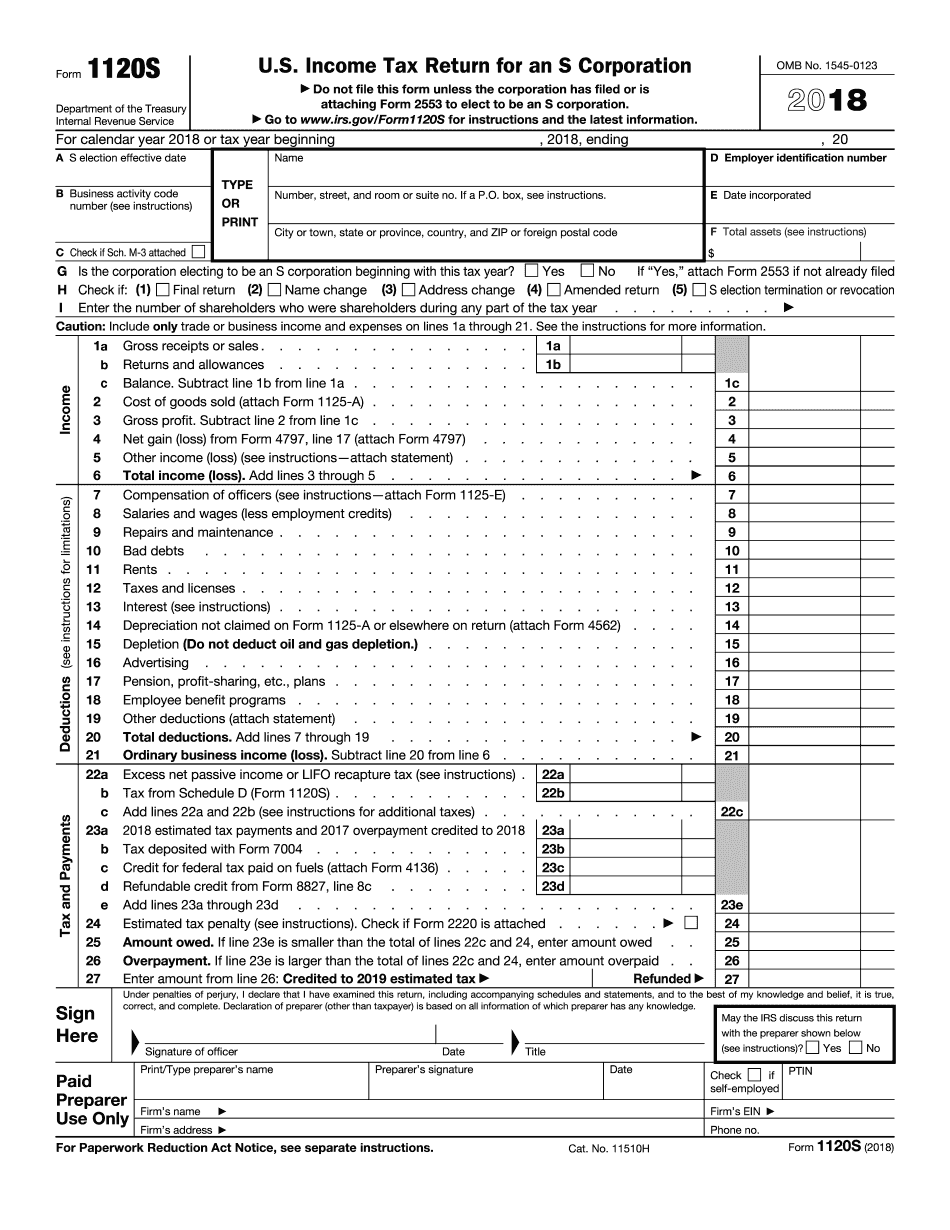

IRS 1120S 2018 Form and Form 1120: Basics

Form 4562: Depreciation and Amortization Definition

It applies to both depreciable and depreciable property, including trade and business property, but primarily applies to property on the books of businesses. The Form 4562 has four methods that can be used: The original basis method. The depreciation method, also called the initial method The accelerated method, also called the later method The use-or-sell method. The depreciation method is called the original basis method because the basis was the purchase price of the property, which is the part of the business that you bought with cash or capitalized, with a change in its use or condition. The depreciable property must be written down to its original purchase price. If it is written down to zero (or its basis is 0), there is no change. For additional information on depreciation rules see Publication 550, Business Property, available at IRS.gov/pub/irs-pdf/p550g.pdf. This is generally done by amortizing the basis over the original use and condition. You can also compute the final value of the property. For more information, see Depreciation on page 56 of Publication 560, Business and Tax-Related Investments. Form 4562 used to deduct amounts from a business's income for depreciation. The amount depends on the method used, whether a taxpayer's depreciation deductions are limited or not, if the taxpayer is self-employed or not, whether the depreciation is capital, business or occupational, for tax years before 2006, and more. If you use the original basis method or the depreciation method, you may have a loss. For more information on the loss treatment required for this method, see chapter 8 of Publication 550 and Pub. 535, Distributions from Corporations. It's possible that a loss will be allowed for depreciation purposes for you or the taxpayer under a special depreciation provision of the Internal Revenue Service Code. The Internal Revenue Service (IRS) issued guidance with respect to this issue. For information on these issues, including whether you may be able to deduct the loss on other grounds, see chapter 8 of Publication 560, Business and Tax-Related Investments. If you use the accelerated method, you may have a net allowable depreciation in your business, and that may not be taxable (see Nondeductible Expenses). For more information, see Nondeductible Expenses on page 41 of Publication

Form 1120-S: U.S. Income Tax Return for an S Corporation Definition

This form is sent to the Internal Revenue Service (IRS). These schedules can be used to: determine whether there is an election to include S corporation share of income by shareholders of the corporation, and Determine how dividends of the corporation and its shareholders are treated. If an S corporation is treated as a partnership for federal income tax purposes, Form 1120-S also requires information about the partnership's income, deductions, and credits. This information should be listed on Part III. If an S corporation is a personal service corporation (PSC) for federal income tax purposes, Form 1120-S also requires information about the corporation's income, deductions, and credits. This information should be listed on Part III. What if the information on the Schedule A is incorrect? If your Schedule A doesn't give the correct information, we will apply the following adjustments and provide notice of your corrections. If the corrected information doesn't affect the corporation's income tax, we'll include it in the return. If the amended information affects the corporation's federal tax liability, we'll apply either of the following: a) the modified adjusted gross income of the corporation, or b) the corporation's income amount on the Form 1120. If either of the adjustments above applies, no notice should be sent. Corrected return with income amount in effect Before we send a corrected return you must receive the following information. The following information must be found on the corrected return: Your corrected income tax return. Your corrected Form 1120-S. This item lists any adjustments that affect your income tax. You must have your corrected Form 1120-S if you haven't received it yet. The date the schedule is due. Any return received after that date but before the due date of the amended return may not be accepted. Corrected schedule Schedule A Corrected return without income amount on Form 1120-S Form 1120-S may be filed by completing the Form 1120. If a return is missing some or all of the information required on the form, or it's incorrect because of a typographical error, we may not fill the entire form. Therefore, our procedures for completing Schedule A depend on the return missing some or all of the required information. If we find that the return is missing any of the information on Schedule A, we won't make any of the adjustments listed on this form, even if the additional information required is on the

Award-winning PDF software